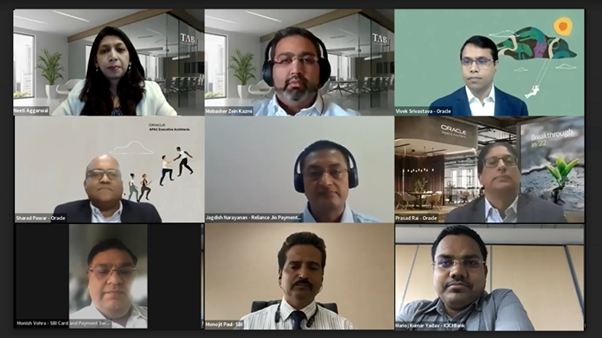

Oracle and The Asian Banker held a high-level dialogue with a select group of senior executives from financial institutions in India to discuss the recent developments in the country’s fast-changing payments landscape and identify new growth opportunities and challenges, as well as technology requirements to future-proof the banking industry from potential disruption.

Joining the discussion were Monojit Paul, State Bank of India; Manoj Kumar Yadav, ICICI Bank; Monish Vohra, SBI Card and Payment Services; Jagdish Narayanan, JioMoney; Sharad Pawar, Oracle; Vivek Kumar Srivastava, Oracle; Sathya Prasad Rai, Oracle.

Report on a seamless digital payment experience

If you want to learn how to deliver a payment system architecture for financial institutions, to build strong capabilities in value storage, transaction processing, verification, and data analytics, download the report now.

In this report, we cover topics such as:

● India’s fast-changing payment landscape

● Future-ready payment capabilities that require a long-term focus on technology, data, and processes

● Banks’ need for agile and cost-effective technologies that will support new business models

Click to download the report: https://bit.ly/3GT0SR8

Click to watch the webinar: https://bit.ly/3xeLZnB

As wallets, instant payments and embedded finance reshape how customers interact with payments across Asia Pacific, card issuance is often assumed to be losing relevance. David Lim of Alliance Bank Malaysia, Anshul Sabherwal of Standard…

Customers in Malaysia increasingly expect international payments to be as seamless as local transfers. At a closed-door roundtable convened by TAB Global with Visa, participants examined how banks are adapting to these expectations while…

The Japan Banking Innovation Conference 2025, held at The Westin Tokyo, convened over a hundred senior banking executives, fintech leaders, policymakers and technology pioneers to discuss the fundamental shifts redefining financial services.

As the global banking industry braces for a challenging 2025, it faces economic headwinds, geopolitical tensions, trade realignments, and the push for sustainability and technological innovation

The AWS Financial Services Symposium Singapore 2024 showcased how AI, data, and cloud technologies are revolutionising financial services. Industry leaders from AWS and HSBC shared insights into advancing innovation, regulatory responsibility…

By continuing to browse this website, you agree to our privacy policy.