Industry leaders at The Asian Banker Finance Vietnam Leadership Roundtable 2024 discussed modernising core banking and payment systems to boost operational resilience, financial stability, and hybrid cloud adoption to address legacy system…

During this RadioFinance session, we explored asset tokenisation and the digital asset world from the perspective of the global banking industry, highlighting key trends and challenges and how it is helping evolve finance.

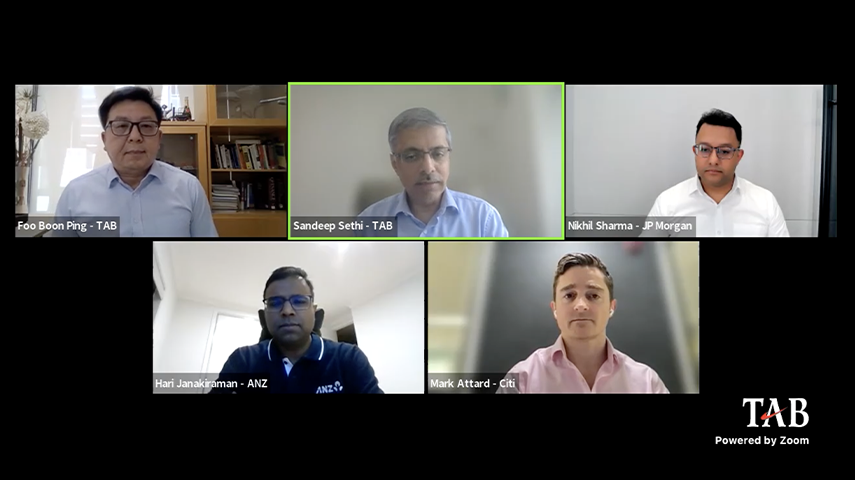

At a recent roundtable hosted by The Asian Banker, industry experts from banks and financial institutions across Asia offered a comprehensive overview of the current challenges and potential solutions in cross-border payments.

Heads of digital asset banks and Hong-Kong based virtual asset exchanges discussed the future of asset tokenisation at the closing session of The Asian Banker Summit 2024 held on 23 May at the Conrad in Hong Kong.

The Hong Kong Monetary Authority is launching a regulatory sandbox for generative AI this year to allow banks to deploy solutions in a controlled environment

As the global financial landscape continues to evolve, digital advancements are playing an important role in reshaping transaction finance, according to a panel at a recent Heads of Transaction Finance Roundtable. The meeting was held in…

At a recent roundtable, chief risk officers (CROs) from major banks across Asia Pacific discussed strategies for tackling emerging threats and building operational resilience in the digital age. The roundtable was held in conjunction with…

Accelerated growth in digital transactions and evolving customer needs require more resilient core, scalable architectures, and strategic AI adoption, according to participants at the Heads of Technology roundtable in conjunction with The…

In a conversation with Ron Shevlin, a renowned banking thought leader, we delved into how the US banks navigate regulatory challenges amid economic uncertainty and strategic shifts